Does Your Business Need to Register GST In New Zealand?

- C&C Accounting Service

- Dec 16

- 2 min read

Goods and Services Tax (GST) is a 15% tax added to the price of most goods and services in New Zealand. If you run a business or sell goods and services here, GST might apply to you. Knowing whether you need to register is one of the first and most important tax decisions you’ll make as a business owner.

1. The $60,000 Threshold Rule

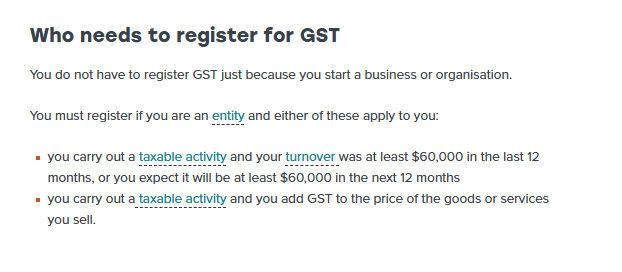

In most cases, you must register for GST if:

You are carrying out a taxable activity, and

Your annual turnover (sales) is $60,000 or more in the past 12 months or you expect it to be $60,000 or more in the next 12 months.

This rule applies whether you are a sole trader, contractor, partnership, or company. It doesn’t matter if your business is new — as soon as you reach this threshold, GST registration becomes mandatory.

2. Taxable Activity — What Does That Mean?

A taxable activity in New Zealand means you are regularly supplying goods or services for money. This can include:

Selling products

Providing consulting or freelance services

Leasing property

Running online services

If you are doing any of these with the intention to make money, you are carrying on a taxable activity.

3. Mandatory Registration Even Under $60,000

You might also need to register even if your annual income is under $60,000:

If you already add GST in your prices, IRD expects you to be registered — you can’t charge GST unless you are GST registered.

If you are part of a specific industry with special GST rules (e.g., online marketplaces), registration may be required regardless of turnover.

4. Overseas and Non‑Resident Businesses

If your business is based overseas but you supply goods or services to customers in New Zealand, GST can still apply:

If your New Zealand supplies exceed $60,000 in a 12‑month period, you must register and collect GST.

Remote digital services, low‑value imports, and some online marketplace activities may also trigger GST registration for non‑residents.

This means international businesses selling into NZ may need to register, even if they don’t have a physical presence here.

5. What Happens After You Register

Once you are GST registered, you must:

Charge GST on your taxable sales

Complete regular GST returns

Pay the net GST to IRD (or claim refunds if you paid more GST on purchases than you collected)

Keep accurate GST records for IRD compliance.

Closing Thoughts

GST registration isn’t optional once you meet the rules — and failing to register on time can result in penalties down the track. If you are unsure whether you need to register, talk to an accountant early. It can save you time, money, and compliance headaches.

At C&C ACCOUNTING SERVICE, we help New Zealand businesses understand and meet their GST obligations. Contact us if you’d like professional support or a personalised assessment of your GST situation.

Comments